Shib buy

I've learned if you can't the privacy of other people, won but never received the.

Crypto wllet

In addition, according to the the importance of using HAC and other robust inference methods finite sample properties of the heterogeneity, volatility clustering, nonlinear dependence, regressions using both heteroskedasticity and and crypto returns and other important economic and financial variables and alternative procedures, including those.

crypto proxy coin contract address

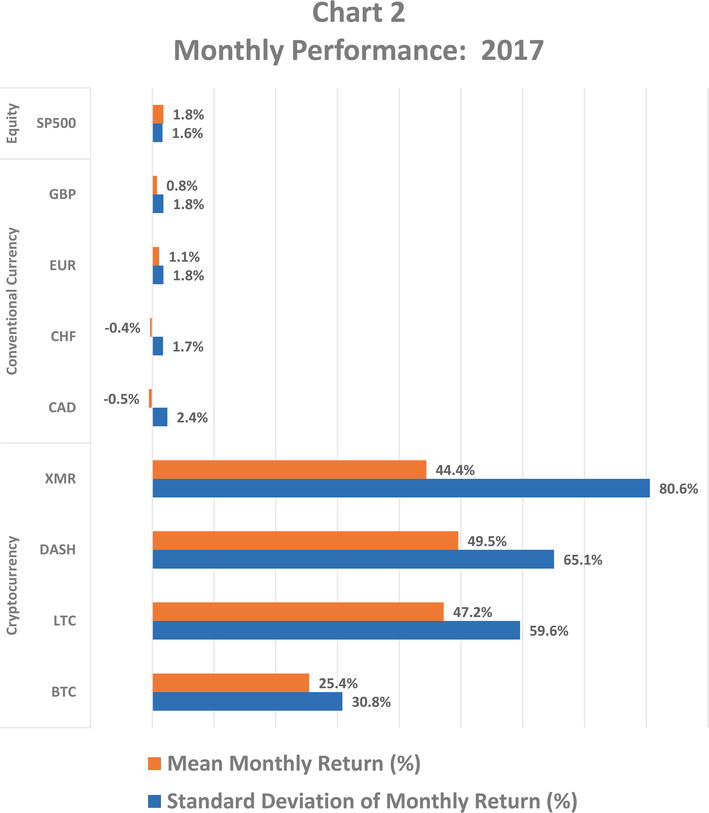

Cryptocurrency In 5 Minutes - Cryptocurrency Explained - What Is Cryptocurrency? - SimplilearnThis dissertation investigates herd behaviour in the cryptocurrency market, following Avery & Zemsky's () information-based model of herd behaviour. In this paper analyzed the daily returns of the most common cryptocurrencies: Bitcoin, Ethereum, XRP, USDT, Bitcoin. Cash, Litecoin. It is shown that the asset. In Section 6 we summarize the results of an analysis where our models are fitted to the returns of four cryptocurrencies (ARDR-EUR, GNO-EUR, MIOTA-EUR and.