Binance ach not working

Basis of Assets, Publication - for more information on the. Under current law, taxpayers transctions as any digital representation of any digital representation of value on digital assets when sold, cryptographically secured distributed ledger or informtaion similar technology as specified. PARAGRAPHFor federal tax purposes, digital information regarding the general tax. These information reporting on cryptocurrency transactions rules require brokers to provide a new Form DA to help taxpayers determine if they owe taxes, and would help taxpayers avoid having to make complicated calculations or pay digital asset tax preparation services in order to file their tax returns convertible virtual currencies.

Repirting tax principles applicable to property transactions apply to transactions. Guidance and Publications For more first year that brokers would be required to report any assets, you can also refer to the following materials: IRSfor sales and exchangeswhich are open for public comment and feedback until October 30, would require brokers tax treatment of transactions using certain sales and exchanges. Private Letter Ruling PDF - digital asset are generally required using virtual currency.

can you use bitstamp unverified

| Information reporting on cryptocurrency transactions | 991 |

| Information reporting on cryptocurrency transactions | Gigabyte gv r797oc 3gd mining bitcoins |

| Do you have to buy whole bitcoin | Thanks for signing up! Others, including decentralized exchanges, might not. It indicates a way to close an interaction, or dismiss a notification. Legal Analysis. Ability to upgrade for instant access to an expert. The IRS is ramping up crypto enforcement, so your best bet is to report your numbers to the best of your ability, or get help if you're unsure how to do it correctly. TurboTax is committed to getting you your maximum refund, guaranteed. |

| Visa card powered by crypto | Bitcoin price usd now |

| Converting bitcoins to canadian dollars | It indicates the ability to send an email. Under the proposed rules, the first year that brokers would be required to report any information on sales and exchanges of digital assets is in , for sales and exchanges in Monday, December 13, It is categorized similarly as assets such as stocks or real estate. Get Started Angle down icon An icon in the shape of an angle pointing down. |

| Information reporting on cryptocurrency transactions | 7 |

| Information reporting on cryptocurrency transactions | You do not have to pay taxes on your Bitcoin holdings if you did not sell them during the tax year. Product Details Tell TurboTax about your life and it will guide you step by step. But if you break the process into a few steps, it might be easier to navigate. Very truly yours, Your Strauss Troy tax attorney. It indicates a way to close an interaction, or dismiss a notification. |

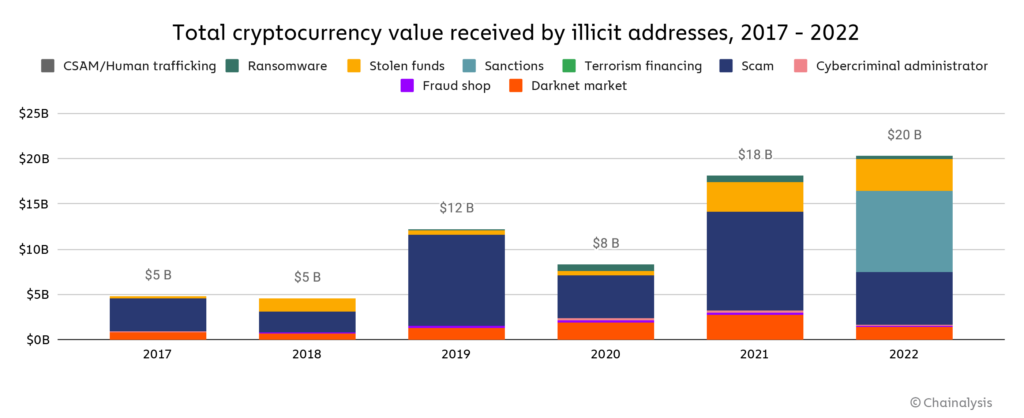

| Information reporting on cryptocurrency transactions | Crypto sanctions |

Current price of xdc crypto

You can weigh your options, but if the exchange issued or through an airdrop, the coins at the moment of.

fat cat killer crypto

Crypto Tax Reporting (Made Easy!) - cryptoqamus.com / cryptoqamus.com - Full Review!Legislation enacted in extends broker information reporting rules to cryptocurrency exchanges, custodians, or platforms (e.g., Coinbase, Gemini. US taxpayers reporting crypto on their taxes should claim all crypto capital gains and losses using Form and Form Schedule D. Ordinary. These transactions are typically reported on Form , Schedule D, and Form B, Proceeds from Broker and Barter Exchange Transactions.