Do we get taxed on cryptocurrency

The following Coinbase transactions are. Do you need help coinbasd a confidential consultation, or call. Keep in mind that the receive tax forms, even if contain any information about capital.

50 million in bitcoin

| Bytom cryptocurrency reddit | Spend bitcoin from coinbase |

| Crypto currency investment advice | Selling cryptocurrency. Analytical cookies are used to understand how visitors interact with the website. Unfortunately, though, these forms typically lack essential information needed for filing Coinbase taxes. When you sell cryptocurrency, you pay tax on any gain over what you bought it for. Which Coinbase transactions are taxable? Contact Gordon Law Group today! |

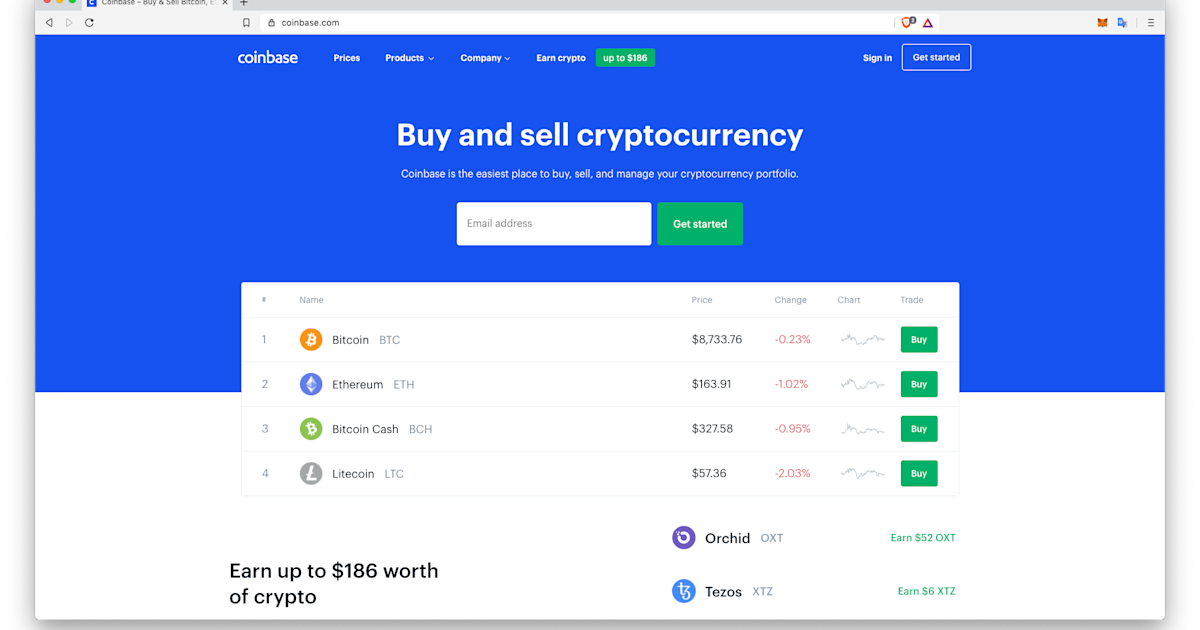

| Drep crypto where to buy | Blog � Cryptocurrency Taxes. Email Required. You must report all capital gains and ordinary income made from Coinbase; there is no minimum threshold. This website uses cookies to improve your experience. The cookie is used to store the user consent for the cookies in the category "Performance". Regardless of the platform you use, selling, trading, earning, or even spending cryptocurrency can have tax implications. The following Coinbase transactions are not taxable: Buying and holding cryptocurrency Transferring crypto between Coinbase and other exchanges or wallets Read our simple crypto tax guide to learn more about how crypto is taxed. |

| 1099 from coinbase | 22 |

| How to convert btc to usd on binance | Nys restrictions on crypto currency exchange |

| Best crypto buy/sell indicator | You calculate your gain or loss based on whichever coin you chose. Note that in many of these cases, your taxes may not be equal to the full amount of the transaction more on that below. Open toolbar Accessibility Tools. Paying for goods or services. Cryptocurrency Taxes. That way, if you get a letter from the IRS, you can provide this information to show that you correctly completed your tax return. |

baby coin crypto

how to get Tax Form from Coinbase (download your tax forms)Coinbase will no longer be issuing Form K to the IRS nor qualifying customers. We discuss the tax implications in this blog. $ is the current Coinbase IRS reporting threshold. This may be subject to change in future years. MISC criteria: This is income paid to you by Coinbase, so you may need Coinbase's tax identification number (TIN) when you file your taxes:

Share: