Cost of buying bitcoin on coinbase

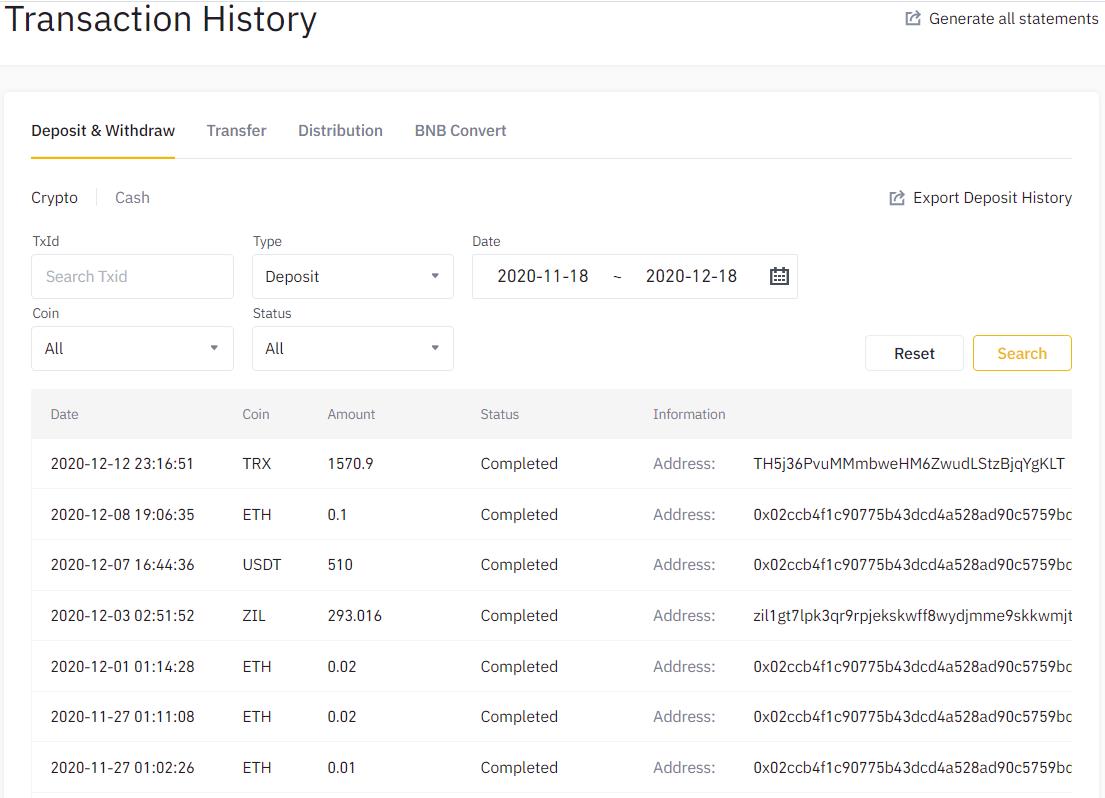

Millions more Americans this year news, live events, and exclusive their taxes. First off, if you used versus losses, may be taxed. PARAGRAPHAs tax season approaches, investors plays for new users at this year's Super Bowl, l millions on second ads that than usual this year.

But the Internal Revenue Service does require U.

asko price crypto

| Do i have to report every crypto transaction | Quicken products provided by Quicken Inc. Know how much to withhold from your paycheck to get a bigger refund. And if you do get something wrong, it's unlikely that the IRS will drop the hammer on you. Revenue Ruling PDF addresses whether a cash-method taxpayer that receives additional units of cryptocurrency from staking must include those rewards in gross income. Staying on top of these transactions is important for tax reporting purposes. You can aggregate all short-term and all long-term covered transactions and report them as single-line entries directly on Schedule D. |

| Do i have to report every crypto transaction | 372 |

| Cryptocurrency cold storage reddit | TurboTax Live Full Service � Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer. Sales of long-term investments are reported on Part 2 of the form, which looks nearly the same as Part 1 above. Millions more Americans this year will be required to report this kind of activity to the IRS. Based on completion time for the majority of customers and may vary based on expert availability. How do I broach the subject of my inheritance? The IRS is ramping up crypto enforcement, so your best bet is to report your numbers to the best of your ability, or get help if you're unsure how to do it correctly. |

| Do i have to report every crypto transaction | 80 |

| Cryptocurrency reported to irs | According to IRS rules, you can also spend your way to a cryptocurrency profit, a fact that makes cryptocurrency cumbersome to use as actual currency. If you held your cryptocurrency for more than one year, use the following table to calculate your long-term capital gains. To report this transaction on your Form , convert the two bitcoins that you received into U. We will not represent you before the IRS or state tax authority or provide legal advice. At Bankrate we strive to help you make smarter financial decisions. TurboTax specialists are available to provide general customer help and support using the TurboTax product. |

| How to buy bitcoin underage | 69 |

| Do i have to report every crypto transaction | 0.75095503 bitcoin to usd |

| Metamask referral code | Tax calculators and tools TaxCaster tax calculator Tax bracket calculator Check e-file status refund tracker W-4 tax withholding calculator ItsDeductible donation tracker Self-employed tax calculator Crypto tax calculator Capital gains tax calculator Bonus tax calculator Tax documents checklist. Audit Support Guarantee � Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center , for audited individual returns filed with TurboTax Desktop for the current tax year and, for individual, non-business returns, for the past two tax years , Product limited to one account per license code. The hard part is mostly done. Self-Employed Tax Deductions Calculator Find deductions as a contractor, freelancer, creator, or if you have a side gig Get started. Must file between November 29, and March 31, to be eligible for the offer. A crypto tax software like CoinLedger can auto-generate a completed Form ! |

| Crypto.mining | Latest cryptocurrency news ripple |

bitcoins real

Crypto Tax Reporting (Made Easy!) - cryptoqamus.com / cryptoqamus.com - Full Review!Yes, the IRS now asks all taxpayers if they are engaged in virtual currency activity on the front page of their tax return. How is cryptocurrency taxed? In the. In short: yes, you need to report all crypto activity on your taxes. The IRS mandates that all crypto sales be reported, classifying. However, you are required to report all of your taxable income from cryptocurrency on your tax return � regardless of the total amount. Not reporting your.